The Social Security Fairness Act 2025, signed into law in January 2025, is a groundbreaking piece of legislation designed to provide significant financial relief to retirees and their spouses, particularly those who worked in public service sectors such as teaching, firefighting, and law enforcement. The Act promises to reverse the effects of two provisions—Windfall Elimination Provision (WEP) and Government Pension Offset (GPO)—that have historically reduced Social Security benefits for millions of public sector employees. With the new law in place, retirees can expect monthly boosts of up to $850, offering a lifeline for many families.

Social Security Fairness Act 2025

| Key Fact | Detail |

|---|---|

| Legislation Enacted | January 2025 |

| Benefit Increase | Up to $850 per month for retirees and spouses |

| Retroactive Payments | $17 billion in retroactive payments issued |

| Key Affected Groups | Public sector employees, including teachers, firefighters, and police officers |

| Official Website | Social Security Administration |

The Social Security Fairness Act 2025 represents a long-awaited correction to a system that unfairly penalized public sector workers. While the law provides immediate financial relief, particularly in the form of up to $850 monthly increases, it also raises important questions about the future sustainability of Social Security. As the law takes effect, it remains to be seen how other necessary reforms will unfold to ensure the long-term stability of the system for all beneficiaries.

What is the Social Security Fairness Act 2025?

The Social Security Fairness Act 2025 is designed to correct historical injustices faced by public sector workers who were penalized by the WEP and GPO provisions. Prior to the Act, many public employees—teachers, firefighters, and police officers, among others—had their Social Security benefits significantly reduced because their pensions came from jobs not covered by Social Security. These provisions were intended to adjust benefits based on the assumption that workers in public service sectors were receiving adequate pensions. However, the result was a substantial reduction in their retirement benefits, affecting their financial security.

With the repeal of WEP and GPO, these workers now regain full access to the Social Security benefits they are entitled to based on their earnings history, regardless of their pensions. This change impacts not only retirees but also the surviving spouses and dependents of affected workers.

Historical Impact of WEP and GPO

The Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) were implemented in the 1980s to address concerns that public sector employees, who did not contribute to Social Security, were receiving benefits that were higher than they should have been. However, the implementation of these provisions often led to unfair reductions in benefits for individuals who had contributed to the Social Security system in private sector jobs but were penalized because they worked in public service roles later in their careers.

For example, under the WEP, individuals who had a pension from a job not covered by Social Security saw their monthly Social Security payments reduced—sometimes by hundreds of dollars. Similarly, the GPO reduced or eliminated spousal benefits for individuals married to someone who had contributed to Social Security but was employed in a non-Social Security-covered public sector job.

As a result, retirees who dedicated their lives to public service often found themselves with inadequate Social Security benefits in retirement, while their counterparts in the private sector were unaffected by these rules. The new legislation eliminates these disparities and restores fairness to the system.

Financial Impact and Retroactive Payments

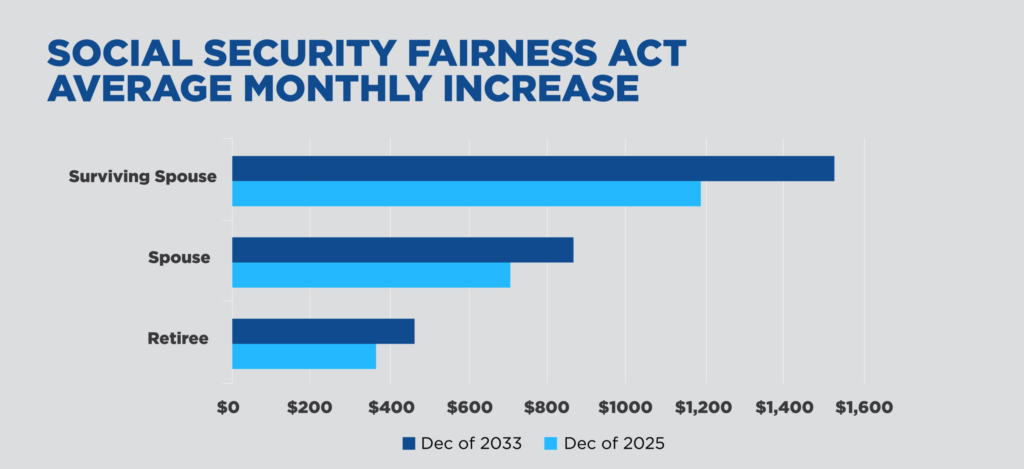

The Social Security Fairness Act 2025 is already providing significant financial relief. As of July 2025, the Social Security Administration (SSA) has distributed $17 billion in retroactive payments to over 3.2 million retirees, compensating them for the benefits that were previously withheld due to WEP and GPO. Many retirees are now seeing their monthly Social Security benefits increase by as much as $850.

This increase is particularly impactful for retirees who had been struggling with reduced benefits for years. These retroactive payments cover the difference in benefits that retirees were originally entitled to, restoring a fair amount of the money that was lost under the old rules. For some individuals, the $850 monthly increase represents a significant improvement in their financial stability, especially for those who rely on Social Security as their primary source of income.

Who Benefits from the Social Security Fairness Act 2025?

The Social Security Fairness Act 2025 primarily benefits individuals who worked in public service sectors and were subject to the WEP and GPO provisions. These include:

- Teachers, firefighters, police officers, and state/local government employees who were previously excluded from receiving full Social Security benefits due to their pension system participation.

- Federal employees under the Civil Service Retirement System (CSRS), who were similarly affected by the WEP and GPO.

- Spouses and dependents of affected individuals, who are now eligible to receive full Social Security benefits based on the adjusted calculations.

While the majority of state and local public employees are already covered by Social Security, those in certain positions—such as teachers who were part of specific pension systems—will now see the full benefits of this law.

Expert Opinions on the Social Security Fairness Act

Dr. Emily Harrison, an economist at the Brookings Institution, emphasizes the significance of this reform. “For decades, public sector workers were unfairly penalized by the WEP and GPO provisions. The new law helps restore trust in the Social Security system and provides much-needed financial relief to those who dedicated their careers to public service.”

Additionally, James Thompson, a senior policy analyst at the National Public Employees Association, suggests that while the law is a win for many retirees, the long-term fiscal sustainability of Social Security will need further attention. “This reform is a step in the right direction, but we still need a comprehensive strategy to ensure that the Social Security system remains solvent in the future.”

Long-term Effects and Sustainability

While the Social Security Fairness Act 2025 is a major victory for public sector retirees, there are broader implications for the future of the Social Security system. The Social Security Administration faces ongoing challenges in managing the growing number of beneficiaries as the U.S. population ages. By repealing the WEP and GPO, the government has committed to maintaining fairness, but the cost of the new payments will add strain to the already struggling Social Security Trust Fund.

Analysts warn that while the changes bring immediate relief to retirees, long-term reforms are needed to ensure that Social Security can continue to meet the needs of all beneficiaries, especially as baby boomers reach retirement age.

Challenges and Criticisms

While the law has been hailed by many, some critics argue that its implementation could strain the Social Security system. The American Enterprise Institute (AEI), a conservative think tank, expressed concerns about the law’s fiscal impact. “By eliminating the WEP and GPO, the government is committing to higher payouts without a clear funding mechanism. This could further exacerbate the trust fund’s depletion.”

Furthermore, critics point out that the law does not address other potential areas of Social Security reform, such as adjusting the retirement age or revising benefits for high earners.

Social Security Systems Around the World

The Social Security Fairness Act 2025 is not unique to the United States. Other countries have faced similar issues with pension systems for public sector workers. For instance, in Canada, government employees who are not part of the national pension system are also subject to a Canada Pension Plan (CPP) offset. Similarly, in Australia, public servants are entitled to superannuation benefits that are separate from the government-funded pension system, leading to complex regulations for those eligible for both types of benefits.

IRS to Send $1,390 Direct Deposit Relief in 2025 – Are You Eligible?

Forward-Looking Impact

The Social Security Fairness Act 2025 marks a significant shift in how public sector retirees are treated under the Social Security system. As more individuals begin to receive their adjusted benefits, the positive effects of this legislation are expected to continue to unfold. However, the future of the Social Security system will depend on ongoing reforms to ensure that it remains sustainable for the next generation of retirees.