In 2025, the Internal Revenue Service (IRS) is set to distribute a direct deposit relief payment of $1,390 to eligible U.S. taxpayers. This payment is designed to alleviate financial pressures on Americans facing rising living costs and inflation. While the program echoes earlier federal stimulus measures, the specifics of the 2025 relief initiative differ in scope and design.

This article provides an in-depth look at the eligibility criteria, distribution process, and the wider economic context surrounding this relief effort.

Direct Deposit Relief

| Key Fact | Detail/Statistic |

|---|---|

| Payment Amount | $1,390 |

| Eligibility | Based on 2023 tax filing; income and dependents |

| Distribution Method | Direct deposit or paper check |

| Start of Payments | Early 2025 |

| State-Level Relief | Varies by state, additional relief in some states |

| Official Website | IRS |

The IRS’s $1,390 direct deposit relief payment is an important step in providing financial relief to U.S. taxpayers facing the ongoing effects of inflation. By staying informed and ensuring that tax information is up-to-date, eligible individuals can benefit from this crucial assistance.

With state-level programs also offering financial relief, the combined efforts of federal and state governments aim to provide a safety net for those most in need.

What Is the $1,390 Relief Payment?

The $1,390 relief payment is a federal initiative designed to provide direct financial assistance to taxpayers in 2025. The payment follows the precedent set by previous relief measures such as the Economic Impact Payments issued during the COVID-19 pandemic, but this time, it is meant to help individuals cope with the ongoing economic challenges, including inflation and increased living costs.

Unlike pandemic-era relief, which was sent to a broader population, the 2025 payment is more targeted, focusing on low- to middle-income households. The payment will be automatically deposited into the bank accounts of eligible taxpayers who filed their 2023 tax returns.

Historical Context: How Does This Compare to Previous Relief?

In previous years, the U.S. government issued stimulus checks to assist households during times of economic crisis. The most notable recent example is the COVID-19 relief packages, which provided several rounds of direct payments (up to $1,400 per individual in some cases). These programs were designed to mitigate the economic fallout of the pandemic, supporting consumers and businesses by directly infusing cash into the economy.

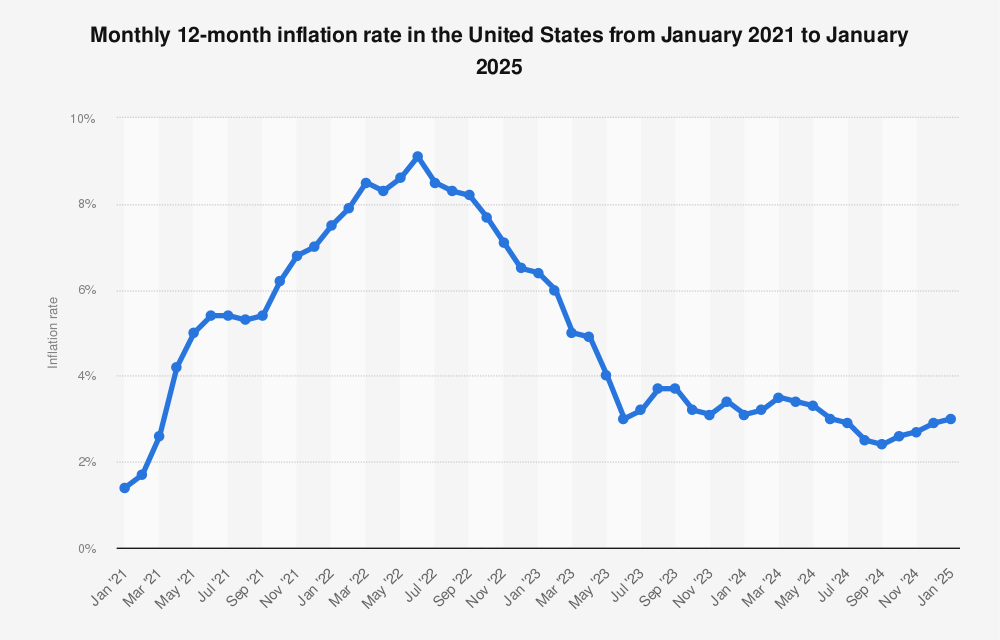

The 2025 relief payment, however, comes in a different context—following a post-pandemic recovery period, but with inflation still a concern. Experts argue that while the pandemic may be over, the effects of inflation on daily expenses such as food, housing, and healthcare remain. The $1,390 payment is part of the federal government’s strategy to provide targeted support to those still feeling the financial strain.

Key Eligibility Requirements for the $1,390 Payment

To be eligible for the $1,390 payment, taxpayers must meet several criteria based on their 2023 tax filings. These factors include income levels, tax filing status, and the number of dependents.

Income and Filing Status

Similar to past relief efforts, eligibility for the $1,390 payment is subject to income limits. For example, individuals who earn less than $75,000 annually, or married couples earning under $150,000, are expected to qualify. These income thresholds are designed to target financial assistance to those most in need.

Taxpayers who filed as single, head of household, or jointly are eligible, with varying amounts potentially available depending on their filing status.

Dependents

Families with dependent children may be eligible for a higher payment amount. Financial experts suggest that households with children or other dependents may receive an additional amount to account for their increased cost of living. For instance, a taxpayer with dependents may be eligible for a payment increase of $250 to $500 per child.

Automatic Distribution

The IRS will distribute these payments directly to bank accounts listed on taxpayers’ 2023 returns. For individuals who do not have direct deposit set up with the IRS, the payments will be issued in the form of paper checks, though these checks may take longer to reach recipients.

How Will the IRS Distribute the Payments?

The IRS has streamlined the process for distributing relief payments, with most taxpayers receiving their $1,390 directly through direct deposit. For those who prefer paper checks, the process will be slower, with potential delays.

It is crucial that taxpayers ensure their bank account information is up-to-date on their 2023 tax return to avoid unnecessary delays. In addition, individuals should monitor the IRS website for updates and information regarding their payments.

Economic Impact and Expert Analysis

The $1,390 direct deposit payment is part of an ongoing strategy by the federal government to provide financial relief during times of rising costs. While it is unlikely to solve all the challenges posed by inflation, economists believe the relief will offer crucial support to lower-income households, helping them cover essential expenses.

Dr. Helen Avery, an economist at the Brookings Institution, stated, “This payment will provide immediate relief to households struggling with rising costs, particularly in areas such as food, housing, and healthcare. However, it should be viewed as one part of a broader strategy for long-term economic stability.”

State-Level Relief Programs

In addition to the federal relief payment, several states have introduced their own assistance programs for residents. These programs vary in terms of eligibility criteria and amounts. For example:

- Pennsylvania is offering rebates between $380 and $1,000, based on income and other factors.

- Virginia is providing up to $400 in state rebates.

- Colorado is distributing up to $1,130 in refunds.

These state programs are often designed to complement federal initiatives, providing targeted relief to residents facing economic difficulties.

How to Confirm Your Eligibility for $1,390 Direct Deposit Relief

Confirming your eligibility for the $1,390 relief payment is simple but requires attention to detail. Here are the steps you can take to ensure you’re covered:

- File Your 2023 Tax Return: Your 2023 filing is the key to determining eligibility. Ensure you have filed by the designated deadline (typically April 15, 2024) to be considered.

- Verify Your Income: The IRS will base your eligibility on your income level as reported in your 2023 tax return. If you are unsure of your eligibility, the IRS website offers an eligibility tool to help you determine whether you qualify.

- Update Bank Information: If you have moved or changed bank accounts since your last filing, be sure to update your information with the IRS to avoid delays.

Impact on Different Demographics

The $1,390 relief payment is expected to have varying impacts depending on the recipient’s demographic profile. Here’s how different groups will be affected:

- Low-Income Households: For those with limited income, the $1,390 payment will provide much-needed support. This group may use the payment to cover basic expenses such as rent and utilities.

- Families with Children: Households with dependents will likely receive a higher payment amount, providing additional support to families with children or other dependents. This extra funding can be pivotal in managing rising costs for childcare, education, and healthcare.

- Retirees: Seniors and retirees on fixed incomes will benefit from the payment as well. While it may not be enough to cover all living expenses, it will provide a buffer against inflationary pressures.

Potential for Future Relief Programs

While the $1,390 relief payment in 2025 is intended to provide immediate assistance, it raises the question of whether further measures will follow. Some financial experts predict that this could be the first in a series of relief efforts aimed at combating inflation over the coming years.

However, such initiatives will depend on broader economic conditions, government policy decisions, and ongoing discussions regarding fiscal responsibility.

Common Misconceptions and Scams

Scammers have been known to take advantage of relief programs by impersonating IRS officials. The IRS has warned taxpayers to be cautious of any unsolicited messages or phone calls asking for personal information.

Remember, the IRS will never ask for personal information over the phone or via email. Always verify any communication directly through the official IRS website.