The UK government’s recent decision to cut Universal Credit (UC) payments by up to £416 a month for families receiving the Limited Capability for Work and Work-Related Activity (LCWRA) element has raised significant concerns. This reform, which is set to impact new claimants starting from April 2026, aims to streamline the welfare system but has drawn criticism for its potentially harmful effects on vulnerable groups, including people with disabilities and those with long-term health conditions.

In this article, we will explore the rationale behind these changes, their potential impact on families, and the steps individuals can take to safeguard their incomes in the face of these reductions.

DWP Cuts £416 a Month

| Key Fact | Detail/Statistic |

|---|---|

| Benefit Cut Amount | £416 per month reduction in Universal Credit payments. |

| Date of Implementation | The cuts affect new claimants from April 2026 onwards. |

| Impact on Existing Claimants | Existing claimants will see payments frozen until 2029/30. |

| Eligibility for Appeals | Claimants can appeal decisions via Mandatory Reconsideration (MR) or tribunal. |

| Official Website | Gov.uk |

What’s Behind the DWP Cuts?

The Department for Work and Pensions (DWP) has set out its vision for Universal Credit reform, stating that the current system is unsustainable and needs to be adjusted to encourage people to move into work. According to the DWP, the reform aims to simplify the welfare system by replacing the LCWRA component with a “health element” that is more closely aligned with the criteria for Personal Independence Payment (PIP).

The LCWRA element, which currently provides up to £423 per month, will be replaced by the new health element, valued at £217 per month. While PIP is intended to support people with long-term disabilities and chronic health conditions, its financial assistance is less generous than the previous LCWRA element.

Historical Context of Universal Credit Reform

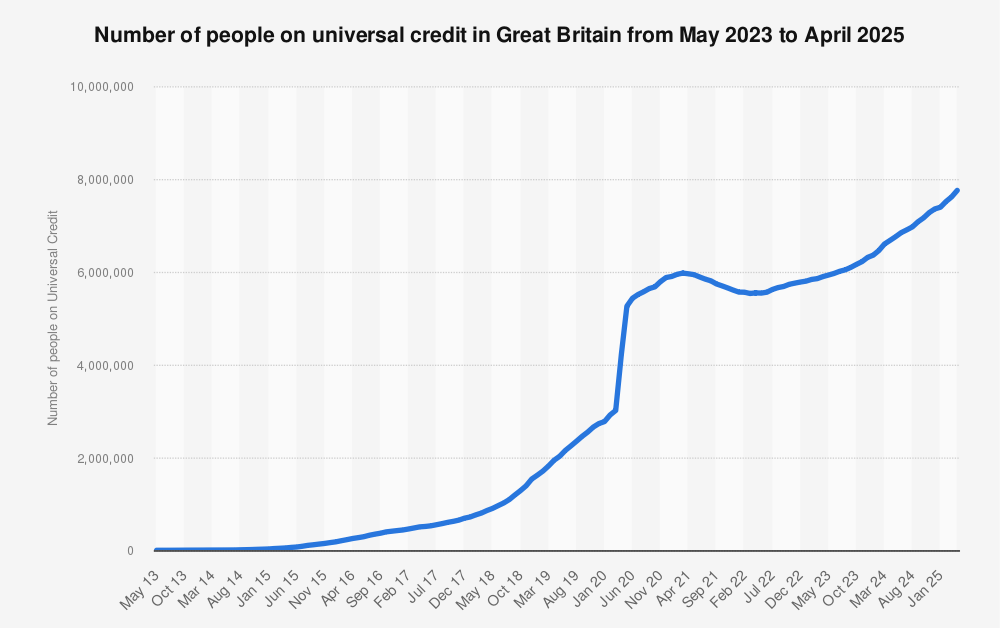

Universal Credit was introduced in 2013 as part of a major overhaul of the UK welfare system. Its primary goal was to simplify the benefits system and encourage work by ensuring that claimants faced fewer financial disincentives when moving into employment. Over the years, various cuts and changes have been implemented to the system, including reducing the amount of money claimants can receive and tightening eligibility requirements.

In 2020, the government introduced temporary increases in Universal Credit payments in response to the COVID-19 pandemic, but these increases were later reversed in 2021. Now, the cuts to the LCWRA element represent the most significant permanent change to Universal Credit in recent years.

Why Is This Happening?

The DWP argues that these cuts are necessary to curb the rising costs of the welfare system, which they argue is unsustainable in its current form. “The welfare system must be reformed to encourage work and financial independence,” stated DWP Minister Jane Smith. “We want a system that promotes self-sufficiency rather than dependency.”

However, critics have raised alarm over the cuts, especially the reduction in support for vulnerable individuals with disabilities or health conditions. Social welfare experts have pointed out that those most affected by the reforms will be people who already face significant barriers to employment due to their health.

Financial Impact on Families

For families relying on the LCWRA element, this reduction could significantly strain their finances. The £416 per month that they currently receive is often used to cover living expenses such as rent, utilities, and food. Many claimants will now have to navigate this financial shortfall with fewer resources available.

According to a report by the Institute for Fiscal Studies (IFS), approximately 1.9 million people in the UK are currently receiving the LCWRA component. The changes to Universal Credit will have a particularly harsh impact on those in the lowest income brackets.

How This Will Affect Vulnerable Groups

The impact of these cuts will not be felt equally across all demographic groups. Some of the most vulnerable groups include:

- Single Parents: Many single parents who rely on Universal Credit will be affected by the cuts. With fewer financial resources, they may struggle to cover childcare costs, rent, and other essential living expenses.

- Disabled Individuals: Those with severe disabilities who have been assessed as having limited capability for work will experience significant reductions in income, making it harder for them to meet their basic needs.

- Low-Income Families: Families who are already living paycheck to paycheck may find it increasingly difficult to balance their finances with the reduced benefit payments.

Government’s Justification vs. Public Sentiment

While the DWP has argued that these cuts are essential for the future sustainability of the welfare system, public sentiment has been largely critical. According to a survey conducted by YouGov, 65% of respondents said they were opposed to the cuts, with many citing concerns over the impact on vulnerable individuals.

“The government’s plan may seem rational on paper, but it completely ignores the reality faced by those with health conditions who can’t simply ‘go back to work,'” said Susan Clarke, an advocate from the Disability Rights Alliance.

What Other Countries Are Doing

Comparing the UK’s welfare cuts to those of other nations offers valuable insight into how different countries handle similar challenges. In Canada, for example, the government has introduced a more nuanced approach to welfare reform, ensuring that people with disabilities and long-term health conditions continue to receive adequate financial support.

Similarly, Australia has faced similar debates over its welfare system, with reforms aimed at ensuring that individuals receiving benefits are also given sufficient opportunities to return to work. However, Australia’s system places a higher emphasis on social safety nets for those with long-term disabilities.

What Can Families Do to Protect Their Income?

As the DWP cuts loom, families who will be affected must start preparing now. Below are several actionable steps to help safeguard income:

1. Review Your Current Benefit Status

Start by reviewing your UC claim to see if you’re currently receiving the LCWRA element. If you qualify, ensure that your medical documentation is up-to-date to prevent delays in any future claims.

2. Prepare for Changes with Financial Planning

Financial advisers suggest taking proactive steps, including creating a strict household budget to better manage resources. Households should consider identifying any areas where spending can be reduced in anticipation of lower benefits.

3. Explore Alternative Income Sources

Families should consider looking for additional income sources, such as part-time work or freelance jobs. Local charities and community groups may also offer assistance, including emergency financial grants.

Future Projections and Long-Term Consequences

Looking forward, these cuts could have long-term social and economic consequences. Experts warn that the most immediate effect will be an increase in financial hardship for many families already living on the edge. Over time, these cuts could result in increased reliance on food banks, local charities, and emergency financial aid.

Furthermore, there could be long-term implications for social inequality, with low-income households facing even more financial stress.

What’s Next?

The government has committed to reviewing the reform’s impact over the next several years. Meanwhile, advocacy groups and social workers are continuing to lobby for the government to reconsider the scale of these cuts, particularly in regard to individuals with severe disabilities.

As the situation unfolds, affected families are encouraged to remain informed about their rights and to seek support from relevant organizations.