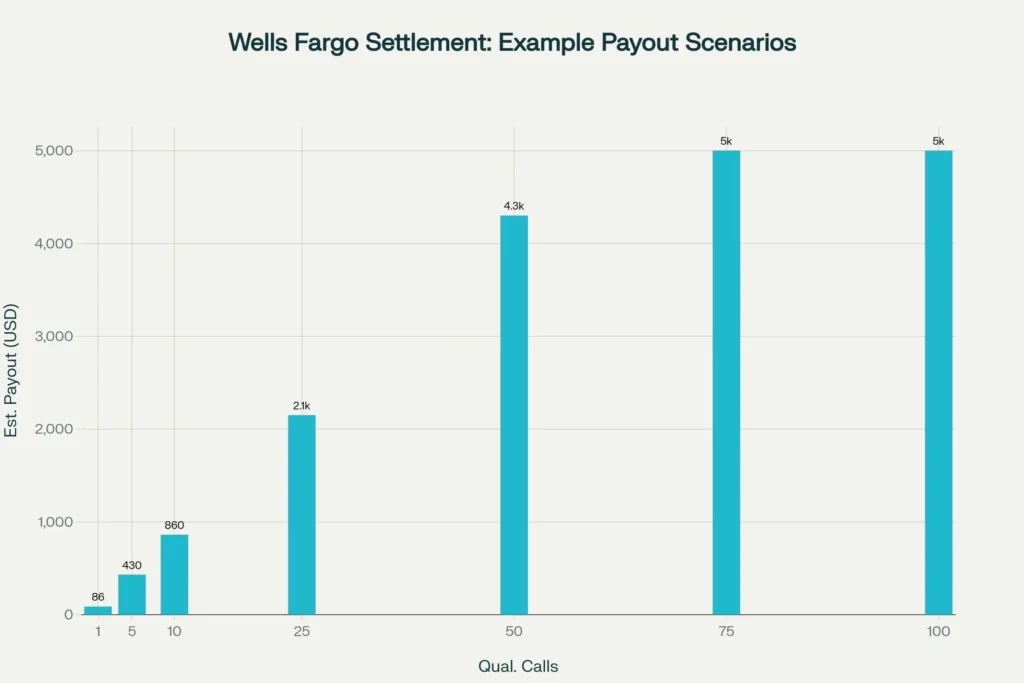

If you’ve heard about unexpected checks showing up from a Wells Fargo settlement, you’re on the right trail. This payout relates to California call recordings that allegedly happened without proper consent, and approved claimants are now receiving money. Most payments are calculated per qualifying call roughly around $86 each with a hard cap up to $5,000 for those who had multiple recorded calls in the covered period. The claims window is closed, so only people who filed on time are in line for a check or direct deposit.

The $5,000 Wells Fargo Settlement is about consent-to-record rules under California law. It covers calls made between October 22, 2014, and November 17, 2023, reportedly recorded by or for a Wells Fargo vendor without adequate consent. You didn’t need to be a bank customer California residents and businesses that received those calls could file a claim. The payment math is straightforward: approximately $86 per qualifying call, with a maximum payout of $5,000 per claimant, typically for people with multiple qualifying calls. Those who submitted claims by the final deadline are now seeing distributions via mailed checks or direct deposit.

Massive Settlement Alert

| Key Point | Details |

|---|---|

| Settlement Focus | California call recordings allegedly made without consent under state privacy law. |

| Coverage Window | October 22, 2014 to November 17, 2023. |

| Fund Structure | Fixed pool; individual payouts based on per-call formula. |

| Who Qualified | California residents and businesses that received qualifying calls. |

| Payout Range | About $86 per qualifying call; maximum up to $5,000. |

| Claim Deadline | Passed; late claims aren’t accepted. |

| Payment Status | Distributions to approved claimants are underway. |

| Follow-Up | Claimants should monitor mail/bank for funds and keep records. |

If you filed by the deadline and your California number(s) matched qualifying recorded calls, you’re likely on the list for a payout under the $5,000 Wells Fargo Settlement. Expect amounts aligned to a per-call estimate, with higher totals for multiple calls up to the cap. Watch your mail and bank, keep your records tight, and respond quickly if any detail needs correction. If you missed this one, take it as a friendly nudge to read class notices promptly next time these windows don’t stay open for long.

What This Settlement Is About

At the heart of this settlement is California’s two-party consent rule for call recording. When calls are recorded without meeting consent requirements, it can trigger liability and class-wide relief. In this matter, a vendor acting in connection with Wells Fargo allegedly recorded calls without proper consent across several years. Rather than continue fighting, the matter was resolved through a settlement fund designed to compensate affected people and businesses using a per-call formula. Importantly, the program closed to new claims after the published deadline, and late submissions aren’t accepted.

Who Can Get A Settlement Check

Two factors mattered most: whether you were in California (as a resident or business), and whether your phone number(s) received qualifying recorded calls during the covered dates. The structure didn’t require a customer relationship with the bank. Instead, eligibility hinged on call activity tied to a specific class definition. If you filed by the deadline and your number(s) matched recorded call logs, you were positioned for a payout based on the number of qualifying calls.

How Much Money Could I Get

The typical estimate was about $86 per qualifying call, aggregated for each authorized claimant. People with numerous recorded conversations could see higher totals, up to the $5,000 cap. Because the fund is fixed, final amounts also depend on how many valid claims were approved and the overall per-call distribution mechanics. That’s why two people with the same number of calls might see modest variations based on fund pressure and administrative adjustments.

How Payments Are Being Sent

Approved claimants don’t need to take any extra steps now. The settlement administrator is issuing checks to the address provided in the claim or depositing funds to the bank details submitted during filing. Timing can vary by bank processing and mail delivery. If you moved or changed accounts after filing, it’s wise to contact the administrator to make sure there’s no mismatch slowing your payment. Always deposit or cash checks promptly and retain documentation for personal records or tax questions.

What To Do If You Already Filed

If your claim was approved, simply monitor your mailbox and bank account. Keep your claim confirmation, note the estimate based on your call count, and verify that your deposit or check matches expectations. If there’s a discrepancy, reach out to the administrator with your claim ID ready. If your payment was mailed to an old address, ask about reissue procedures and verification steps to update your details.

Missed The Deadline? Here’s Where You Stand

If you didn’t submit a claim by the deadline, you won’t receive a payout from this particular settlement. That said, class settlements arise frequently in areas like consent-to-record, data privacy, overdraft practices, and account servicing. The practical play is to monitor official settlement portals, major consumer publications, or class-action clearinghouses. When you receive a class notice in the future, read it immediately deadlines are strict, and early action is the difference between getting paid and missing out.

Why The $5,000 Wells Fargo Settlement Matters

California’s consent-to-record standards are among the toughest in the country. This case shows how violations intentional or not can lead to real money for affected people and businesses. It also highlights the transparency of per-call distribution: a simple formula that’s easy to understand and administer. For companies, the lesson is clear: get consent right, every time. For consumers, it’s a reminder to pay attention to mailed notices and email alerts about potential class benefits.

Practical Tips For Claimants

- Keep Records Handy: Save your claim confirmation, any emails from the administrator, and copies of the check or deposit notice for your files.

- Watch Your Mail And Bank: Checks and direct deposits don’t always arrive at the same time for everyone. Give it a reasonable window before escalating.

- Update Details Quickly: If your address or banking changes, inform the administrator fast to avoid returned mail or payment failures.

- Handle Checks Promptly: Deposit as soon as possible and confirm your bank has cleared the funds.

- Plan For Taxes: While many class payouts aren’t taxable as “wages,” tax treatment varies. Keep documentation and consult a tax professional if unsure.

Common Confusions, Clarified

- Separate From Other Wells Fargo Matters: This settlement is not the same as prior enforcement actions or account-related remediation programs. Eligibility is tied to consent-to-record rules and qualifying calls during specific dates.

- Non-Customers Could Qualify: A bank account wasn’t required. If your California number received covered calls and you filed, you could be in the pool.

- Per-Call Formula, Fund Limits: The roughly $86-per-call estimate and $5,000 cap help explain why amounts differ by person: the more qualifying calls on your number, the higher your potential payout up to the ceiling.

- Closed Claims: The window is shut. If you missed it, focus on spotting future opportunities quickly and responding before deadlines pass.

- Administrator Is Your Best Contact: For status questions, address changes, or reissues, the settlement administrator can verify your details and resolve issues.

2026 Social Security COLA: Benefits Increase by 2.8% (+$56), But Rising Costs Could Offset the Boost

How This Fits Your Search Intent

- Informational: This guide explains what the settlement covers, who qualified, and how the payout mechanics work.

- Transactional: For those who filed, it outlines what to do next, what to expect, and how to handle missing or delayed payments.

- Navigational: If you need to follow up, locate your confirmation details and use the official administrator channels referenced in your notice emails or letters.