Across the country, many Americans are closely watching the latest financial relief news, particularly surrounding a possible $1,800 stimulus check. With inflation and the rising cost of living continuing to weigh heavily on families, a direct cash infusion could provide much-needed breathing room. While not yet officially confirmed at the federal level, widespread reports and discussions have generated a wave of anticipation about who might be eligible and when the payments might actually arrive.

The conversation has grown louder as households struggle to balance day-to-day expenses like rent, groceries, and gas. For many, stimulus payments during previous rounds offered critical relief. This time, the possibility of a new round of direct payments has captured the public’s attention even more.

Table of Contents

$1,800 Stimulus Checks

While the introduction lays out the growing interest in the stimulus discussion, the real question for millions of people is simple: Who qualifies and when can they expect to see the money? The reported proposal suggests that eligible individuals may receive a one-time $1,800 payment. The aim is to ease financial burdens, support low- and middle-income households, and stimulate local economies.

Unlike earlier pandemic-related stimulus checks, this reported round focuses primarily on income eligibility, tax status, and residency requirements. Direct deposits are expected to be the primary method of distribution, making the process faster and more secure for most taxpayers. Paper checks would likely be issued to those without direct deposit information on file with the IRS.

While this plan has yet to be fully confirmed at the federal level, understanding the eligibility framework can help households prepare ahead of time.

$1,800 Stimulus Checks Overview Table

| Key Information | Details | Additional Notes |

|---|---|---|

| Payment Amount | $1,800 one-time payment | Expected to be a single distribution |

| Eligibility | U.S. citizens or legal residents, valid SSN, recent tax return on file, not claimed as dependent | Certain exceptions may apply |

| Tax Years Considered | 2023 or 2024 tax filings | IRS will use the most recent return |

| Payment Method | Direct deposit (preferred), paper check or mail | Based on IRS records |

| Estimated Rollout | October 2025 | Subject to change pending official confirmation |

| Application Requirement | None reported; based on existing tax and IRS information | Automatic distribution expected |

| Program Status | Reported, not yet officially authorized at the federal level | Monitor government announcements |

Eligibility Requirements for $1,800 Stimulus Checks

If the $1,800 stimulus check becomes official, eligibility will likely mirror prior relief payments in some ways.

First, individuals must be U.S. citizens or legal residents with a valid Social Security number. Residency and legal status verification ensure that funds are distributed appropriately and securely.

Second, the payment will be tied to your most recent tax return — typically for the 2023 or 2024 tax year. If you’ve filed your taxes and have valid income data on file with the IRS, you may automatically qualify. Those who are not required to file a return because of low income may still be eligible, as long as their information is already recorded with the IRS through prior filings or benefit programs.

Third, you cannot be claimed as a dependent on someone else’s tax return if you wish to receive the full payment directly. In prior stimulus rounds, dependents often did not receive the same payment amount as independent filers, though they might have been factored into their family’s total.

Finally, this relief effort appears targeted especially toward low- and middle-income earners, seniors, veterans, and individuals receiving government benefits. Exact income thresholds have not been publicly confirmed yet, but they are expected to be similar to previous stimulus qualifications.

How and When Payments Will Be Distributed

Timing is one of the biggest questions on everyone’s mind. If approved, payments could start rolling out as early as October 2025.

For most recipients, the IRS is expected to rely on direct deposit, which is faster and more secure than paper checks. If your bank account information is already linked to your IRS profile from your last tax return, you’ll likely receive your payment automatically without taking any further steps.

Those who don’t have direct deposit information on file could receive a paper check or prepaid debit card by mail. This process typically takes longer but ensures that everyone eligible still gets their share.

It’s also worth noting that previous stimulus checks were distributed in phases. Higher-priority groups such as those with direct deposit often received their funds within days of processing, while mailed payments could take weeks.

How to Prepare and Make Sure You Don’t Miss Out

Even though no action may be required to receive the payment, it’s wise to take steps now to ensure your information is up to date.

- File your tax return — If you haven’t filed for 2023 or 2024, do so as soon as possible. The IRS uses tax data to verify eligibility and distribute funds.

- Set up or confirm direct deposit information — This will help ensure you get your payment faster.

- Check your IRS records — Confirm your address and personal details are current.

- Beware of scams — No agency will call, text, or email you to “register” for a stimulus payment. If someone claims they can get you your check faster, it’s likely a scam.

- Monitor official announcements — The IRS and Treasury Department will issue formal details once or if this stimulus program is authorized.

What to Do if You Don’t Receive Your Check

If the program is officially approved and you believe you qualify but don’t receive your payment, there are steps you can take:

- Check your payment status online. The IRS typically offers a portal to track stimulus payments.

- Verify your eligibility. Make sure your income, filing status, and dependency status meet the requirements.

- Contact the IRS if necessary. If you filed taxes and everything is in order, they may be able to provide updates.

- Claim a credit later. In prior stimulus rounds, those who didn’t receive their payment could claim it as a Recovery Rebate Credit on their tax return the following year.

Common Questions About Eligibility

Will seniors and retirees receive the $1,800 stimulus check?

Yes, seniors and retirees are expected to be eligible, particularly those receiving Social Security or other federal benefits. Payments will likely be sent automatically if they have information on file with the IRS.

What about people who didn’t file taxes?

Those who didn’t file taxes may still be eligible if the IRS has their information through other benefit programs. In previous stimulus programs, non-filers had special options to register. A similar system could be set up again.

Will dependents receive the payment?

Individuals claimed as dependents on someone else’s tax return are typically not eligible to receive the full payment directly. However, families claiming dependents may receive an additional amount.

Will the payments be taxed?

Like previous stimulus checks, the $1,800 payment is not expected to be taxed or reduce your future tax refund.

Is this a guaranteed payment?

As of now, the stimulus has been widely discussed but not officially authorized by the federal government. That means details are subject to change until formal legislation is passed.

Why This Stimulus Matters

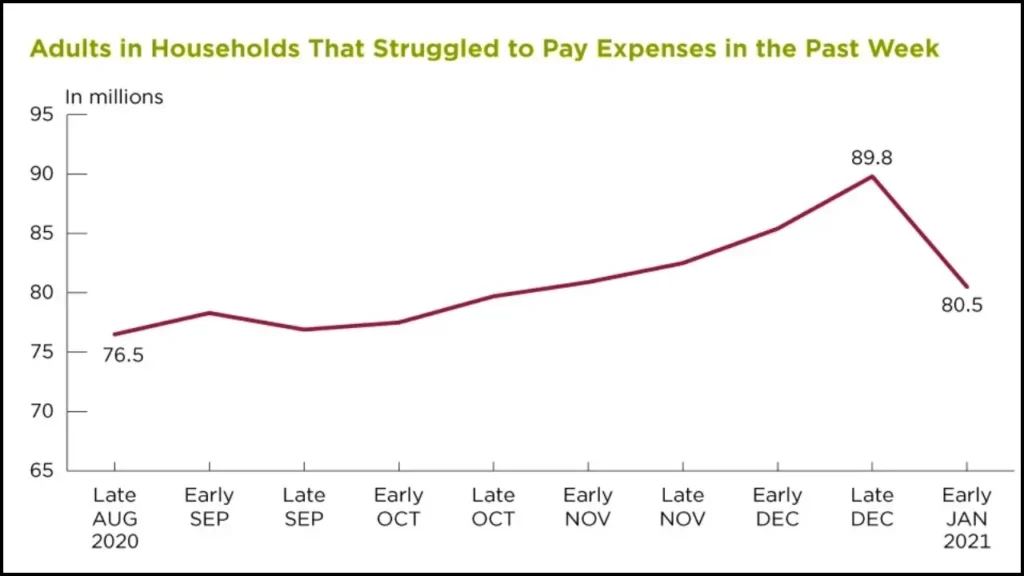

For many households, the economic pressures of recent years haven’t fully eased. While inflation has cooled slightly in some sectors, essentials like housing, food, and transportation remain expensive. A one-time $1,800 check could help millions of families cover urgent costs, pay down bills, or build a small financial cushion.

Stimulus payments also have a broader economic effect. When households receive direct payments, that money often flows quickly back into the economy through local businesses, retail, and services. This helps support jobs and stabilize communities during challenging times.

Caution: Misinformation and Scams

Whenever stimulus payments are mentioned, scammers often take advantage of the public’s interest. It’s essential to stay alert:

- No government agency will call, email, or text asking for personal information to receive your stimulus.

- You should never pay a fee to claim or “speed up” your payment.

- Official updates will always come from verified government channels like IRS.gov or Treasury.gov.

Final Thoughts

The buzz around a potential $1,800 stimulus check has many Americans hopeful for some relief. While the program is not yet fully authorized, understanding the potential eligibility criteria and preparing in advance can help you avoid delays and stay informed.

If approved, these payments could begin rolling out as early as October 2025, with direct deposits reaching eligible households first. Keeping your tax information updated and monitoring official announcements will be key to ensuring you don’t miss out.

As with any financial relief program, it’s important to stay cautious, informed, and patient. Whether this particular stimulus becomes a reality or not, the conversation around economic support reflects how critical financial stability is for millions of households.

Is the Social Security Fairness Act Helping You? 3.2 million Americans May Be Affected

FAQs About $1,800 Stimulus Checks

Q1: Do I need to apply for the $1,800 stimulus check?

No, if the program is approved, payments are expected to be distributed automatically using IRS records. No separate application should be required.

Q2: What if I moved recently?

Make sure to update your address with the IRS to ensure paper checks or debit cards reach you if direct deposit is unavailable.

Q3: Can non-citizens qualify?

Only legal residents with valid Social Security numbers are expected to qualify.

Q4: How long will it take to get my payment?

Direct deposit recipients are typically among the first to receive payments. Paper checks can take several weeks.

Q5: Will this affect my tax refund next year?

No, stimulus payments are not taxable and will not reduce your future tax refund.